Empower your teams to sell more of your solutions, more profitably, and ensure increased revenue opportunities in the future.

IEFC is an independent lessor with a very unique business model in that we own and operate our own equipment return / refurbishment facility and the entire off-lease equipment disposition process. Owning the entire lifecycle enables us to offer your customers the best leasing experience possible with very competitive and flexible arrangements. Our programmatic approach focuses on providing long-term value for you, our vendor partner as well as your customers.

Backed by 25 years of experience in both technology and financial services, our market expertise is unparalleled; and, as an independently owned organization, we have additional flexibility to help our partners design solutions that our competition simply couldn't offer.

IEFC is focused on building long-term relationships and protecting your brand reputation. Not only is IEFC committed to your success today, but tomorrow and into the future.

Our offering is rooted in transparency and integrity, that is aimed at delighting your clients. Clear documentation, fair end-of-term and industry leading asset management will have your clients walking away happy.

IEFC owns and operates a 46,000 sq. foot state-of-the-art technology refurbishment and resale facility; unlike most lessors, we want equipment back at end-of-lease. IEFC is your partner from start to finish.

Creating a captive financing program is unquestionably a game changing advantage, but one that comes with a litany of complex factors and risks. IEFC has the expertise, resources, infrastructure, technology and the experience to be your trusted financing partner. A captive powered by IEFC allows you to compete on a larger level, while simultaneously freeing you up to focus and invest where it matters most.

Empower your sales team through allowing them to offer flexible financing solutions alongside your goods and services.

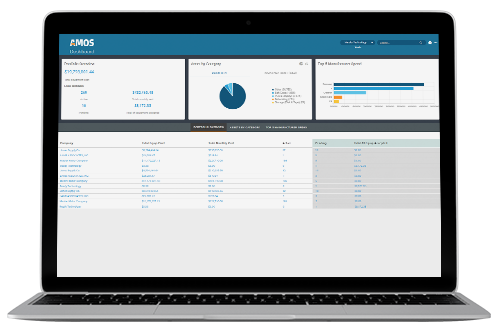

IEFC arms you with its best-in-class asset management system for your clients – empowering better management of technology assets. Not only do your clients get access to AMOS, you are provided with access to our Vendor Gateway to give you visibility to your customer portfolios.

0